-

NASDAQ Golden Cross – June 26, 2025

The crowd is excited again. Growth stocks are at all-time highs. The latest development is the NASDAQ golden cross. Wall Street has a lot to cheer about. Many of...

Read More -

Stocks are Overbought – June 12, 2025

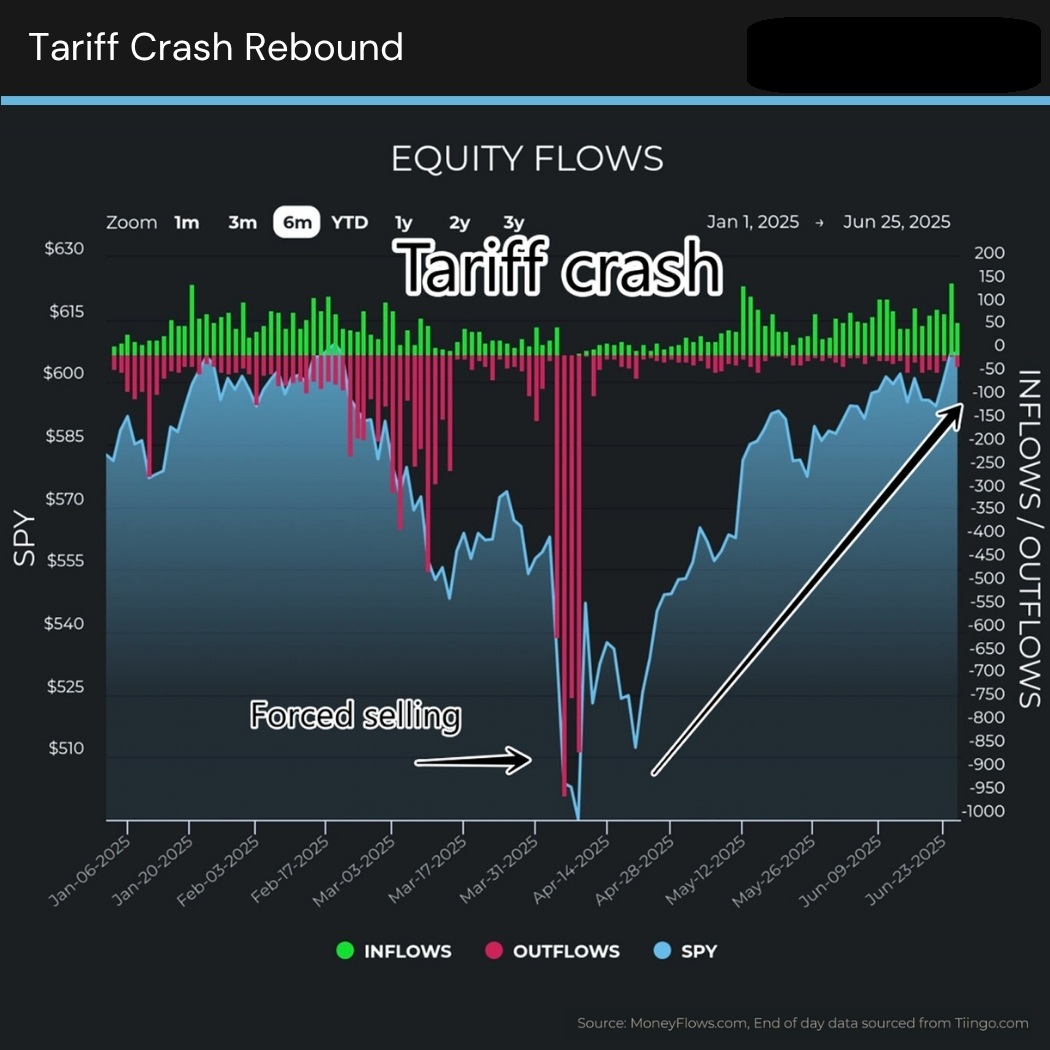

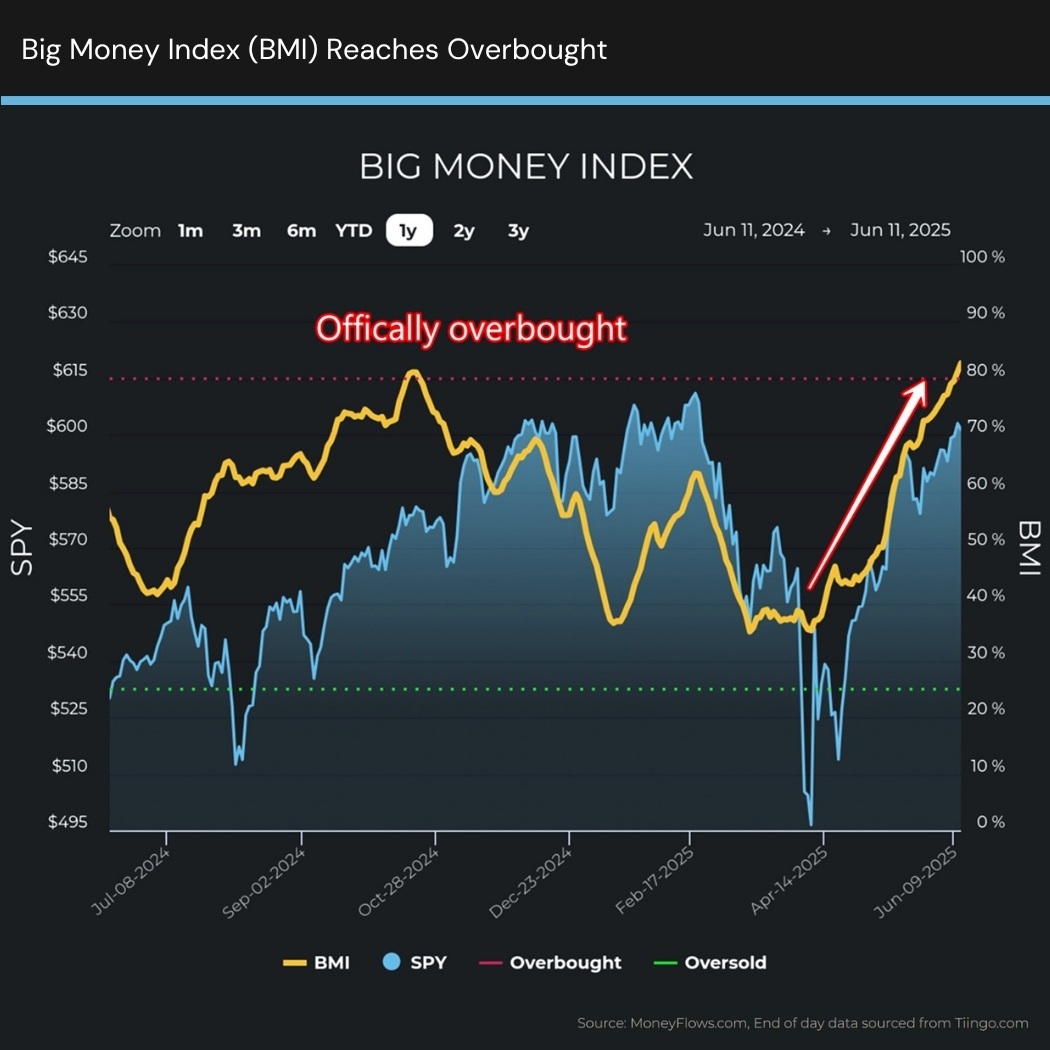

The unthinkable happened. 2 short months ago, stocks recorded record outflows. Fast forward to today, stocks are overbought. I’ve said it before, and I’ll say it again. Rarely does...

Read More -

Forced Flows and the Blowoff Top – June 5, 2025

The crowd is finally in agreement. Investing in stocks is a great idea. This has the potential to ignite forced flows and a blowoff top. It’s simple. The biggest...

Read More -

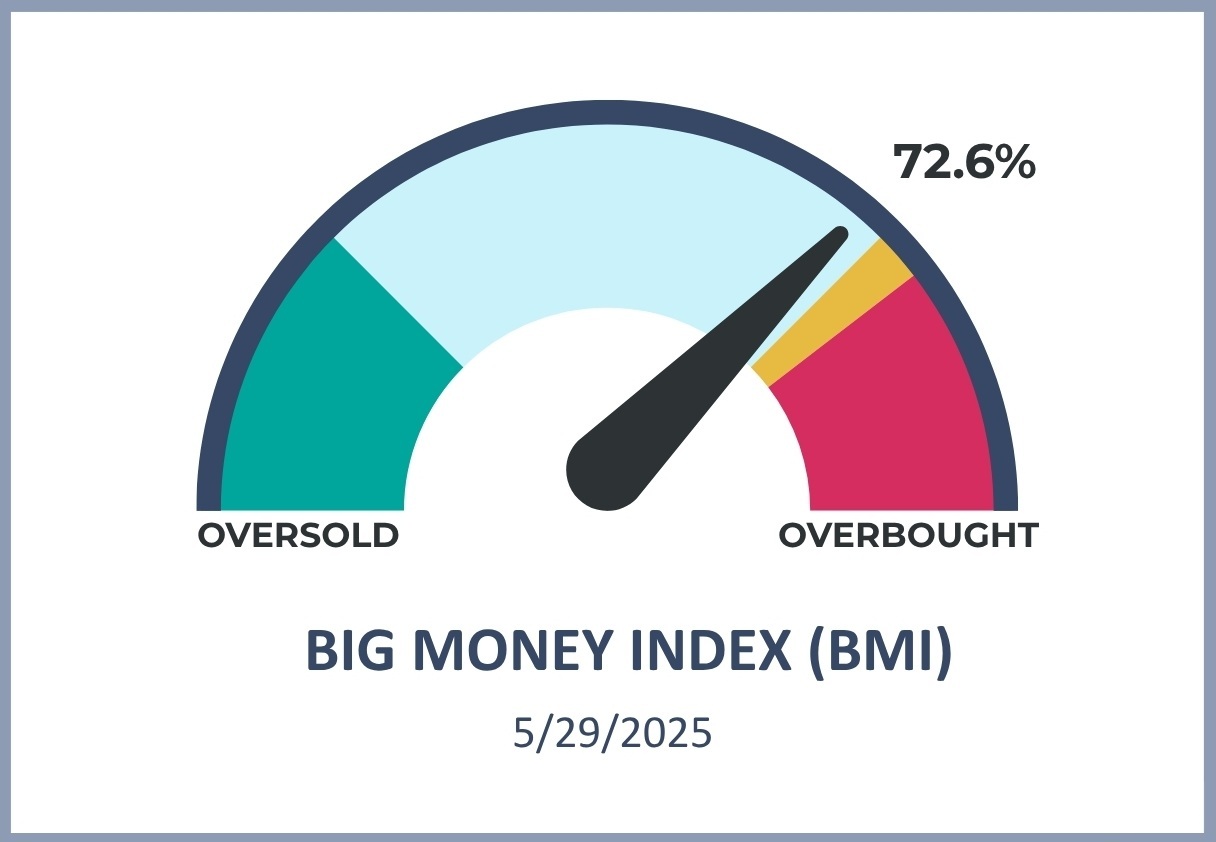

Extreme Overbought Conditions – May 29, 2025

Growth stocks are making highs daily. One of the greatest risk-on environments is unfolding before our eyes. You need to prepare for extreme overbought conditions. Today’s message is simple:...

Read More -

USA Credit Downgrade & Forward Projections – May 22, 2025

The epic rally stalled. Many are describing the setback as an elaborate unsolvable debt spiral. I think it’s simpler…and it all kicked off last Friday. Let’s unpack Moody’s USA...

Read More -

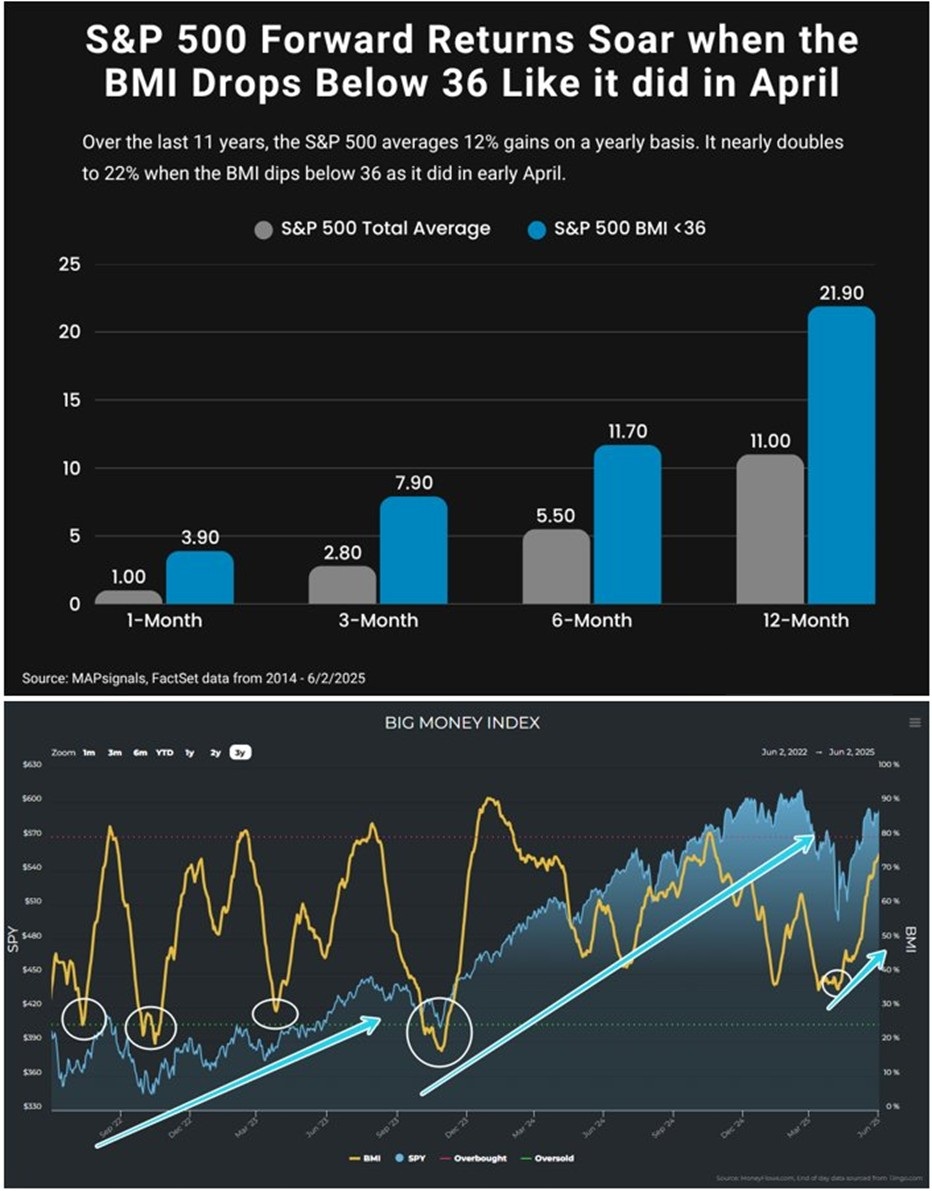

Market Rally Breadth & Future Projections – May 15, 2025

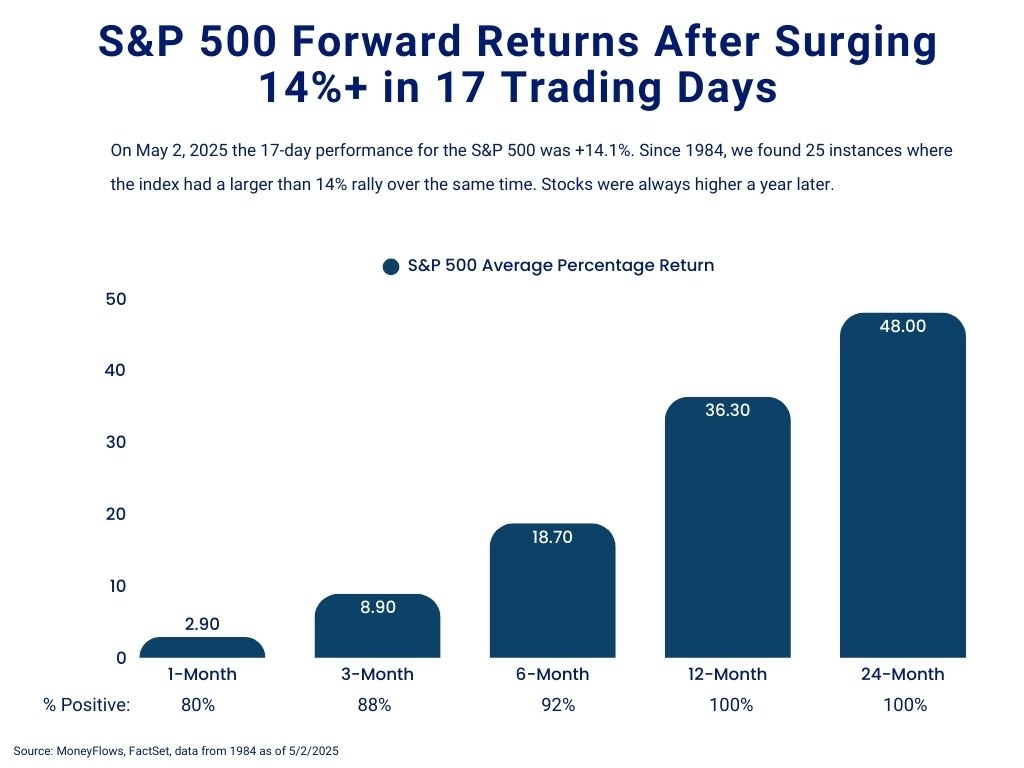

The equity rally has been breath-taking. A month ago, the crowd capitulated. Today they are buying in droves. Let’s unpack the market rally breadth & future projections. Here’s an...

Read More -

Brand New Leadership & Mid-Cap Surge – May 8, 2025

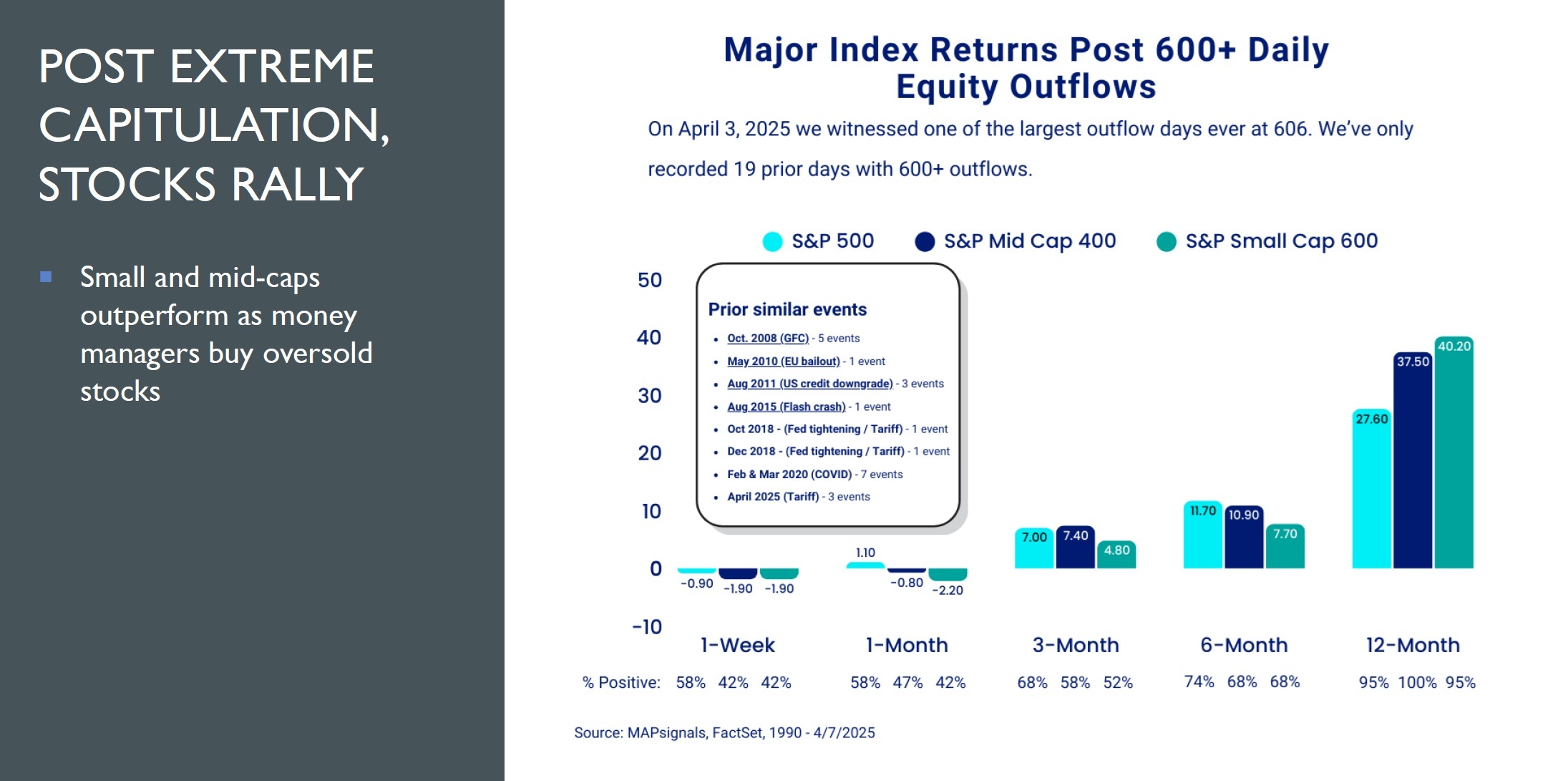

A month ago, stocks crashed. Pundits claimed equities were “uninvestable.” Instead, the unthinkable happened. Brand new leadership and a mid-cap surge has emerged, and this breath-taking rally has legs...

Read More -

Forced Buying – May 1, 2025

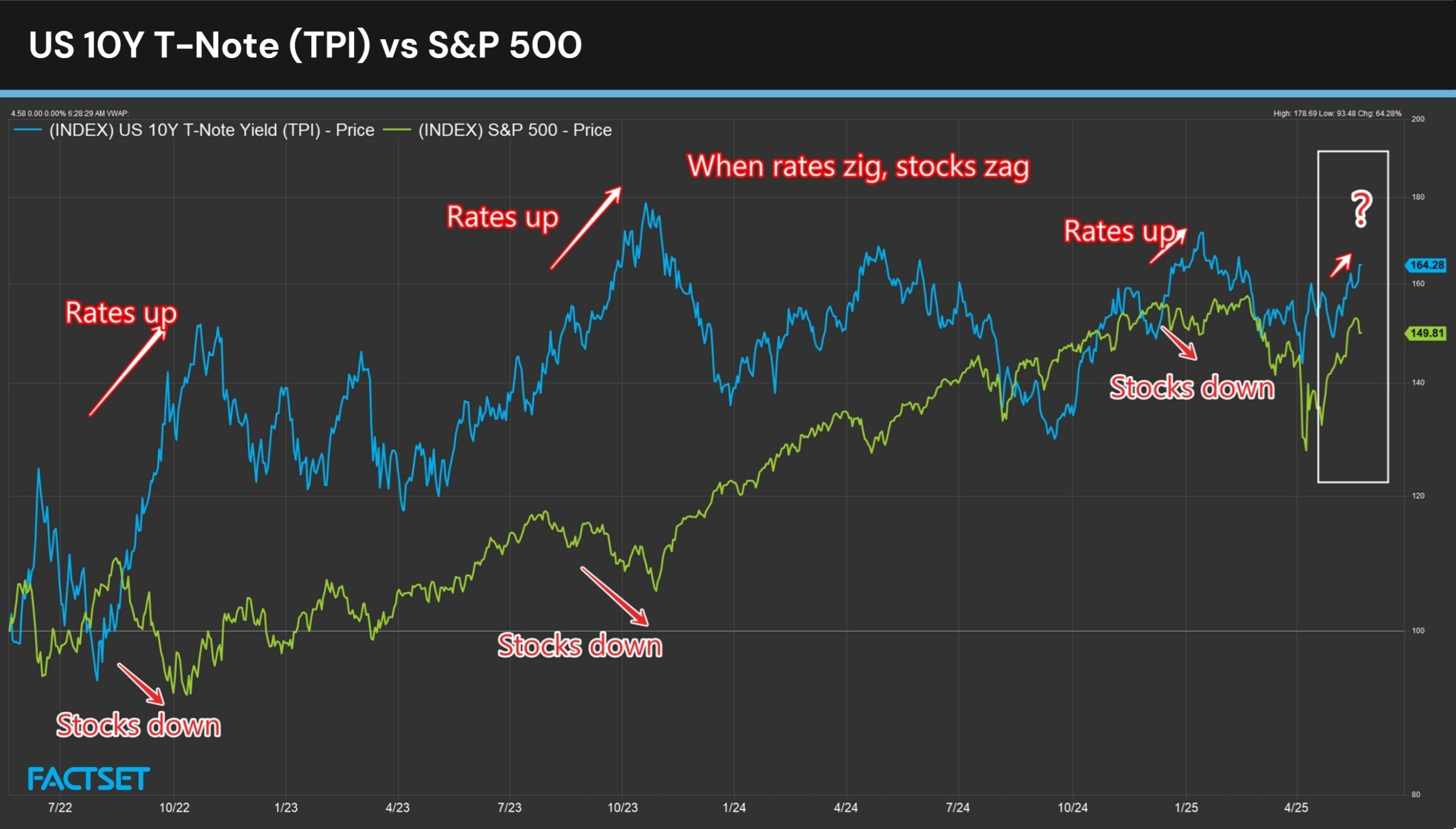

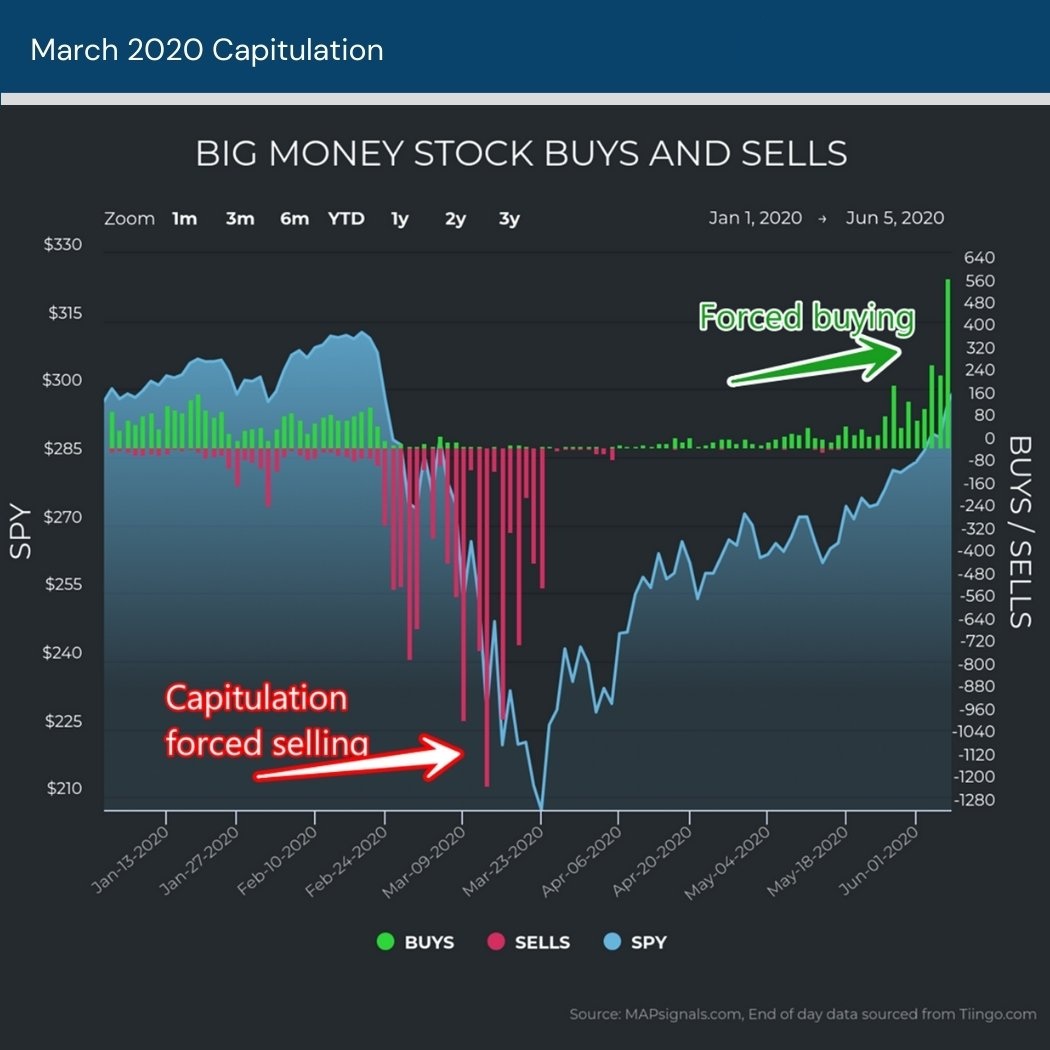

Just 3 weeks ago, the pundits had you believe stocks were damned. Today the crowd is stunned. We’re witnessing 7 consecutive days of green. Extreme capitulation often triggers forced...

Read More -

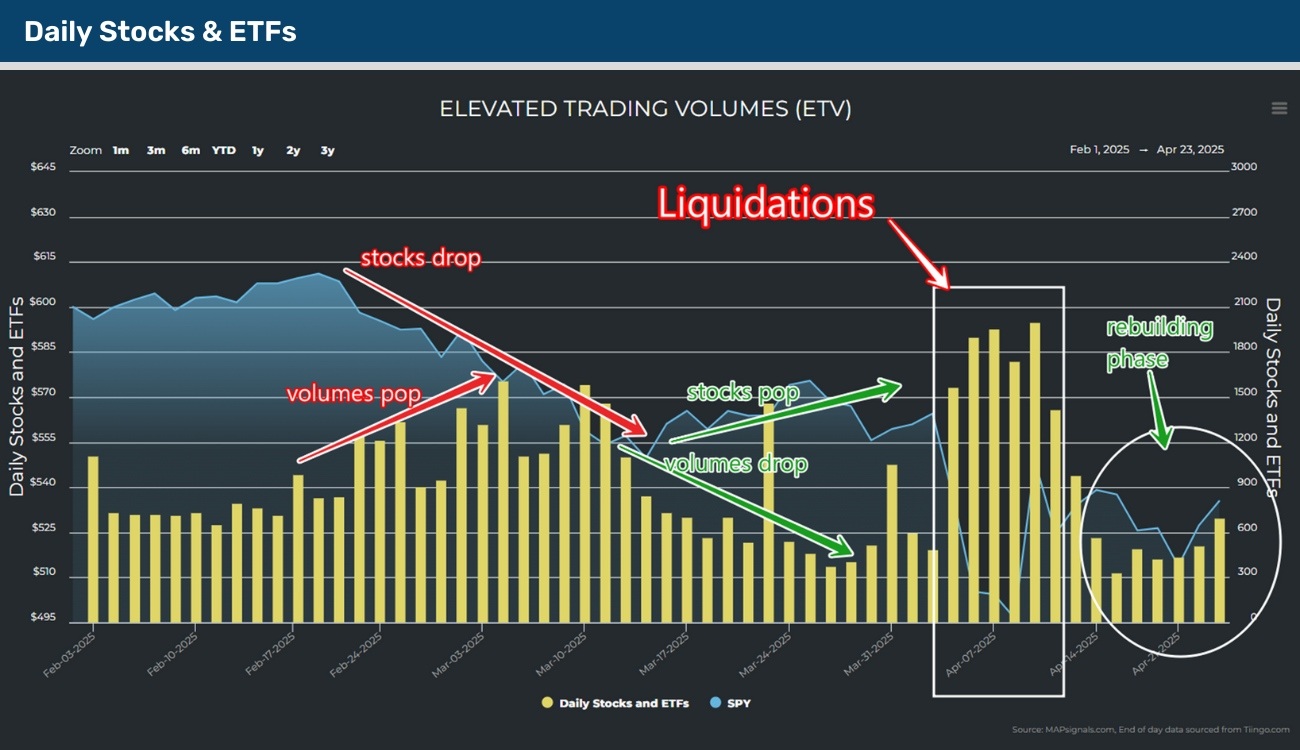

Volatility Crash

Stocks may have bottomed. Capitulation appears long gone. There’s a rare volatility crash signal also appearing. Recapping tariff headlines is futile. One minute there’s no deal, then there’s a...

Read More -

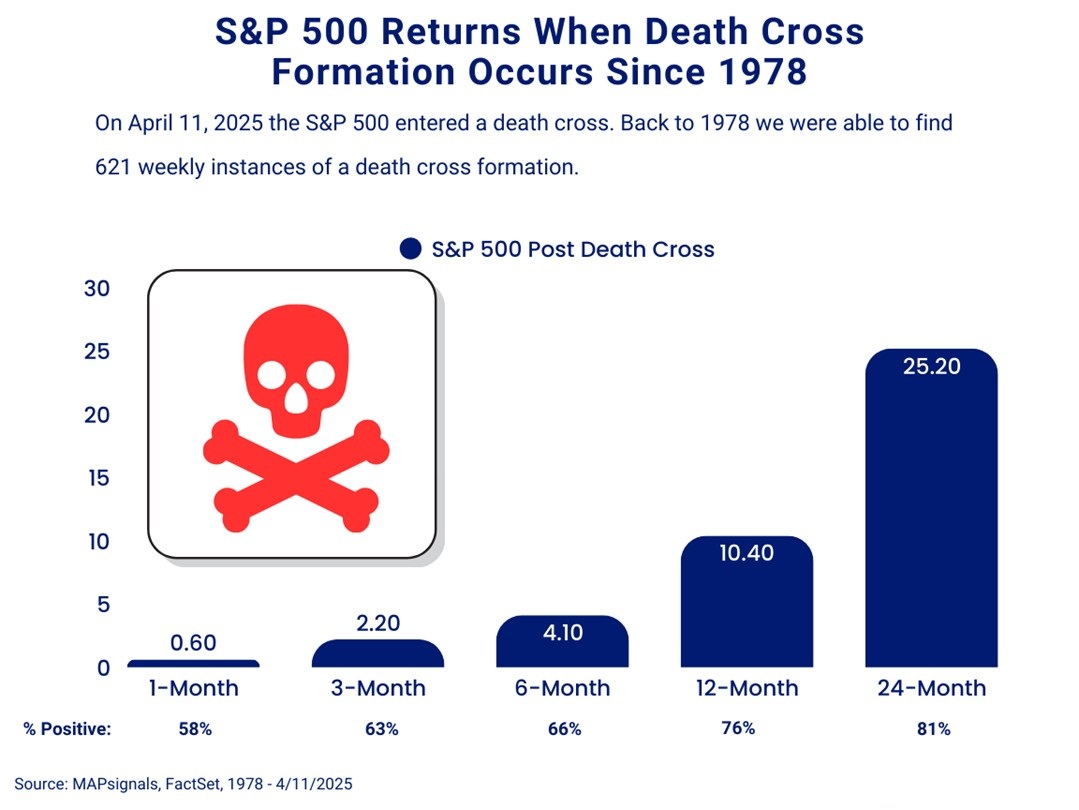

DEATH CROSS – April 17, 2025

It’s been a challenging few weeks. Stocks are falling. Investors are scared. Then we find out that the S&P 500 formed a death cross. Tariffs are causing extreme uncertainty....

Read More