Brand New Leadership & Mid-Cap Surge – May 8, 2025

A month ago, stocks crashed.

Pundits claimed equities were “uninvestable.”

Instead, the unthinkable happened.

Brand new leadership and a mid-cap surge has emerged, and this breath-taking rally has legs to run.

Consider this: Estimates suggest that 80% of forest fires are human caused. What’s important is what occurs once the flames burn out.

Nature eventually heals. Out of the ashes springs new life.

Did you know that 100% of stock market fires are caused by humans? It’s true. Tariffs ignited the latest blaze.

But as we’ve witnessed time and time again, money is quickly put to work and new leadership emerges from the equity embers.

Fortunately, money flows help us spot this cyclical pattern.

Over the past month, our flow data reveals a monster appetite for company specific mid-caps.

Today, we’ll review the equity landscape. More importantly, we’ll lock-in on the biggest beneficiary of capital coming out of the crash.

Under-the-surface there’s a new bull market sprouting.

Stocks Explode from the Lows

Exactly one month ago, stocks were in a bear market.

Volatility reached multi-year highs, and we experienced one of the steepest drops ever for the S&P 500.

The crowd was in pure panic mode.

Our stance was constructive as we provided a data-driven outlook based on 15 extreme charts for April.

While not perfect, here’s what transpired for indices from the lows…this is what you call a face melting rally.

The S&P 500 is up 13%. The NASDAQ ripped 16%.

Small and mid-caps are up double-digits as well.

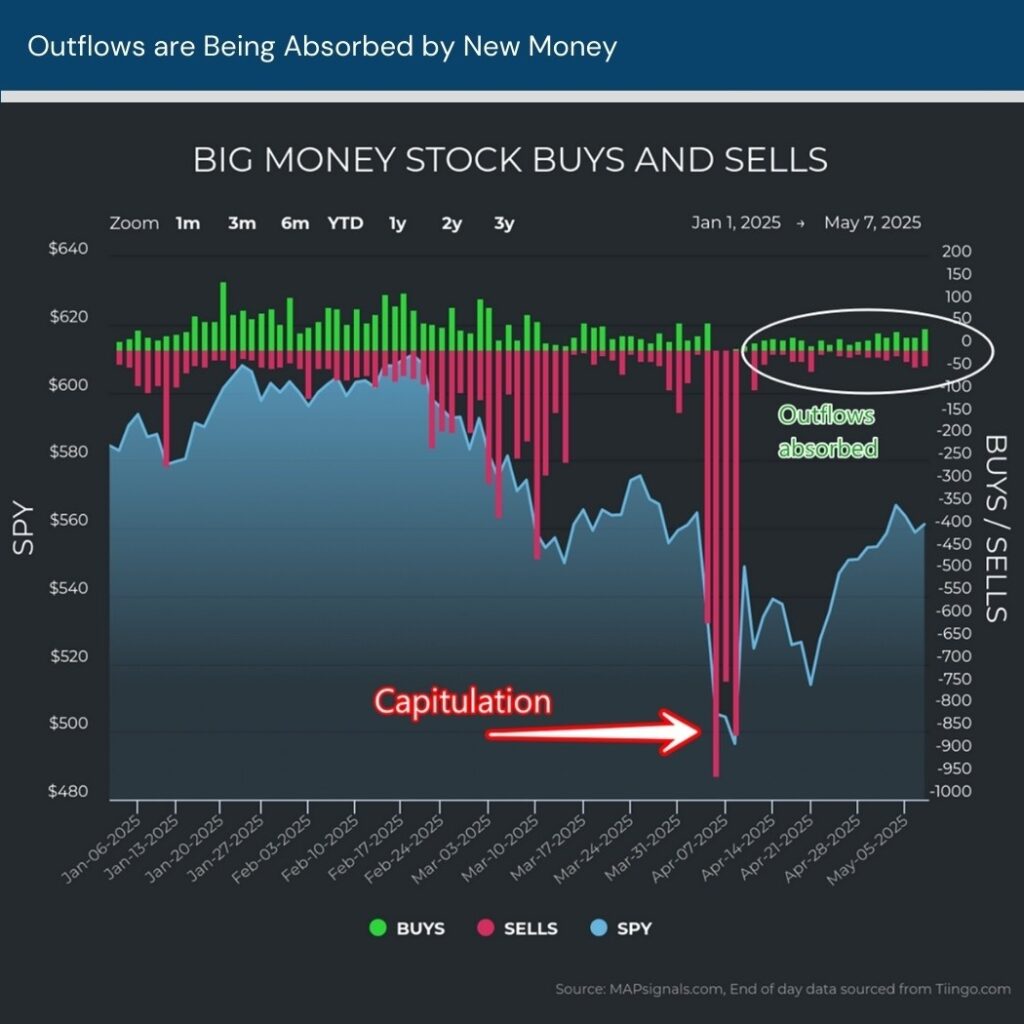

The single reason for the revival is simple: capitulation stopped.

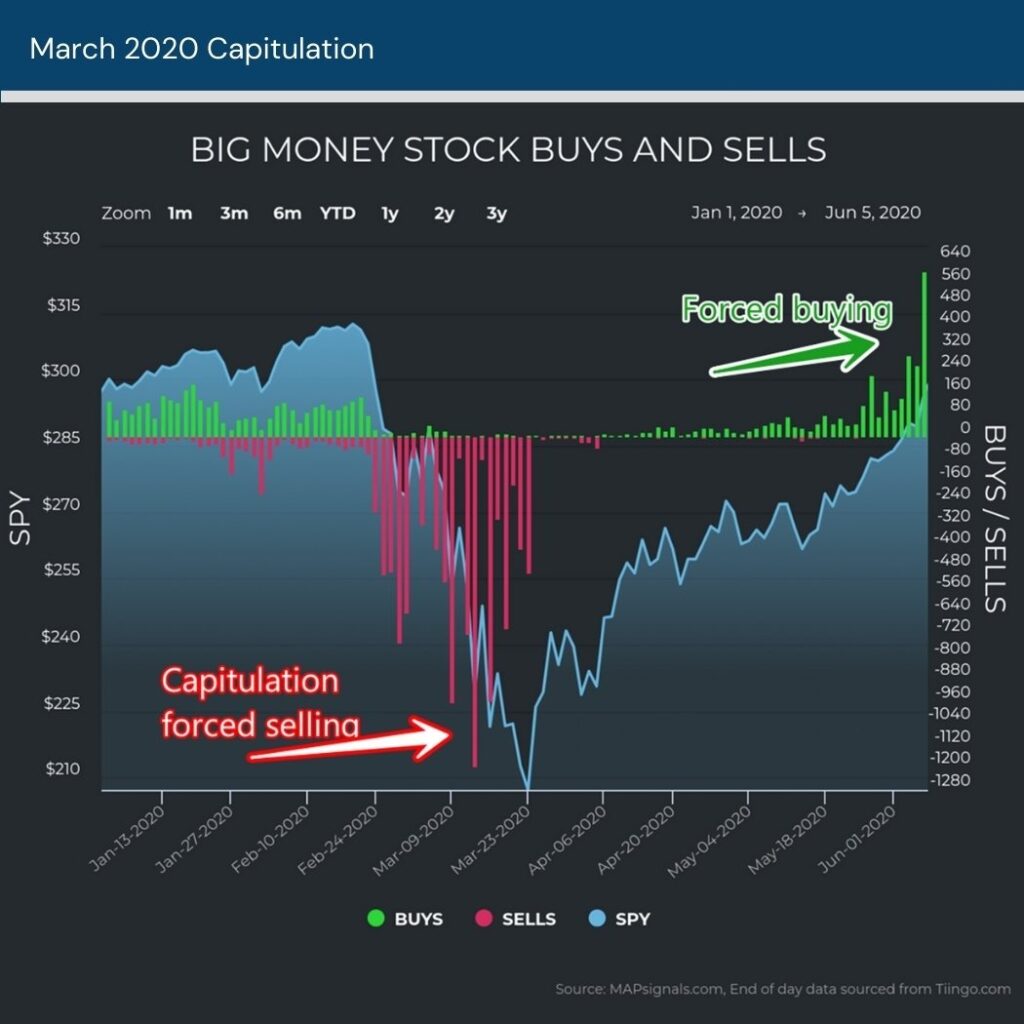

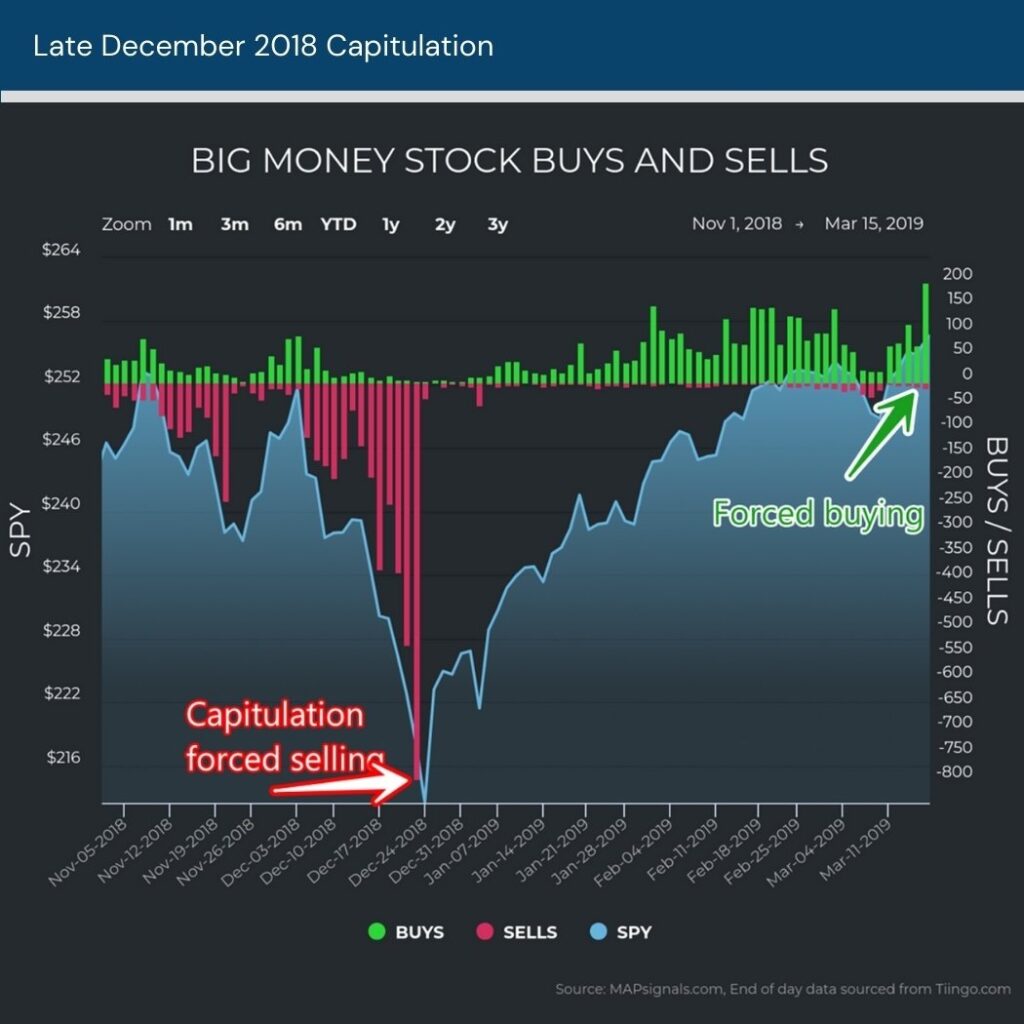

We discussed last week how today’s environment is very similar to the COVID-19 crash and late 2018 crash.

Both of those episodes revealed the same pattern we are witnessing today.

First, capitulation sends stocks violently lower.

Then outflows slowly become absorbed by new money being put to work.

Finally, forced buying occurs.

We’ve yet to see the forced buying…but it’ll be here before you know it. Look at the COVID crash playbook of 2020:

Now check out late 2018:

Look at where we are today. Capitulation stopped and green spuds of inflows emerge:

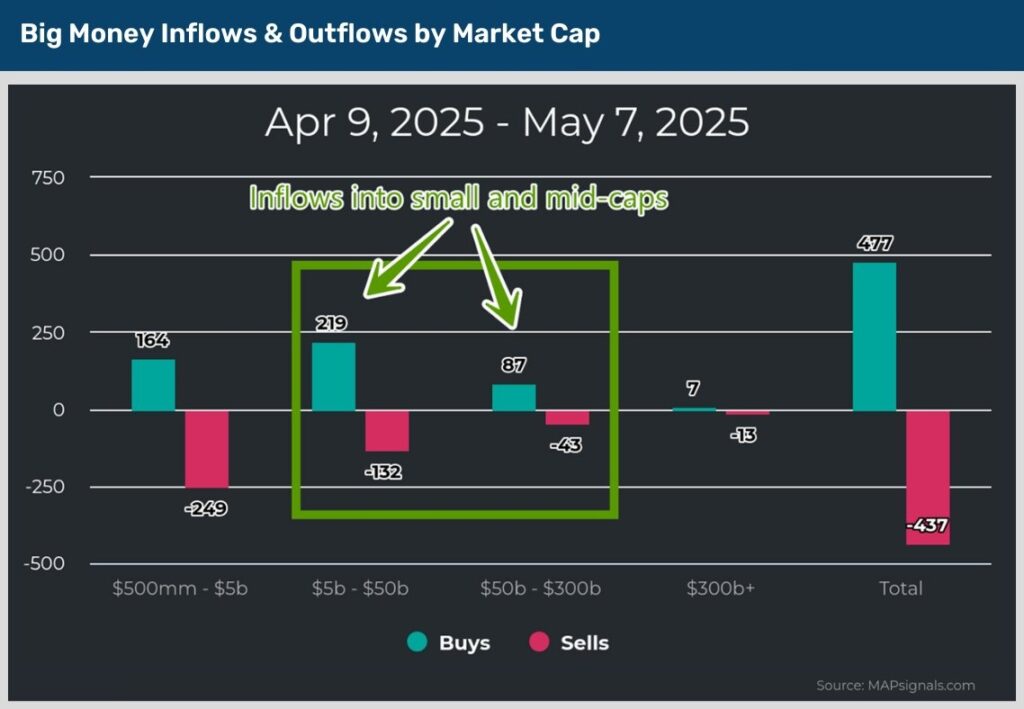

Let’s drill down further. There’s a clear beneficiary of new capital.

Brand New Leadership & Mid-Cap Surge

Below plots all equity flows the last month broken out by market cap. Only one area has experienced net inflows.

Stocks with market caps of $5 billion to $300 billion have experienced 306 buys (inflows) compared to 175 sells (outflows).

Keep in mind these are discrete companies…clearly there is a rush of money flowing into under-the-radar stocks:

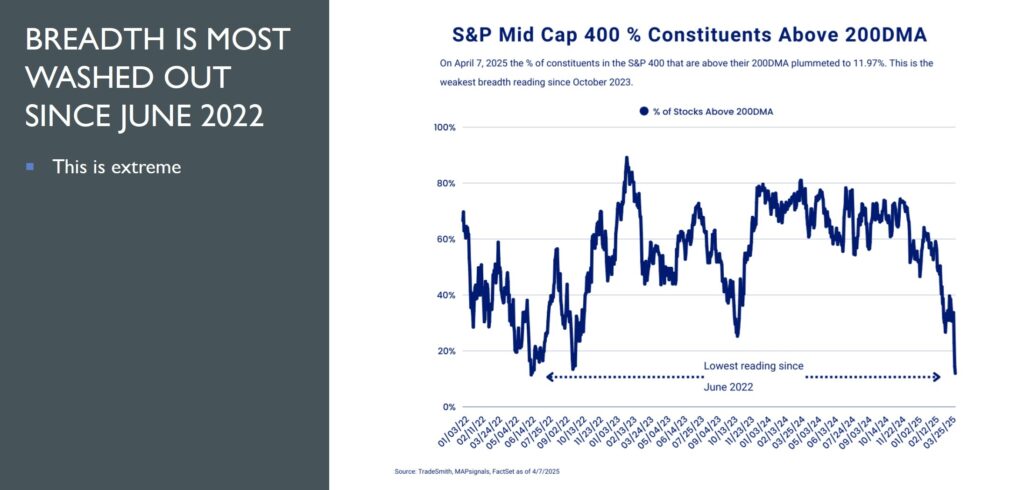

And this risk-on action shouldn’t come as a surprise. Last month we noted just how washed out this group was.

On April 7th, just 12% of the S&P Mid Cap 400 constituents were above their 200DMA:

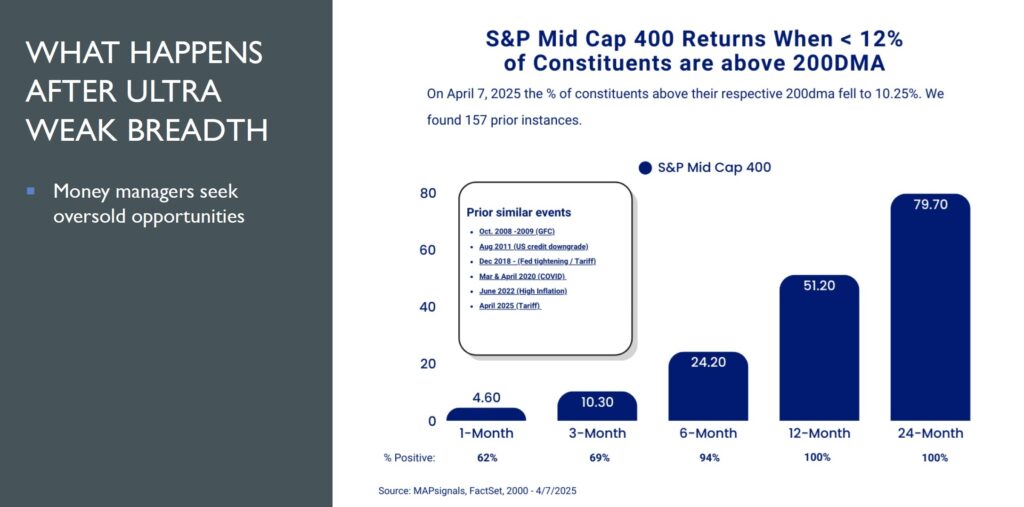

We included a signal study highlighting what comes next…

Hug a bear. They need it!

Mid-caps rip after ultra weak breadth.

Extreme downs lead to extreme ups…

All that’s left to do is focus on the discrete names accelerating higher.

This is where our process shines!

If you want to find tomorrow’s winning stocks, focus on best-of-breed stocks loved by institutions.

It’s that simple.

We have a weekly report that showcases the Top 20 inflows. This is the crème de la crème of stocks…the all-stars.

This is where we found companies like Super Micro Computer (SMCI) in the Summer of 2022…before everyone else.

Or NVIDIA (NVDA) in the summer of 2015.

Our systematic approach spots outliers early on.

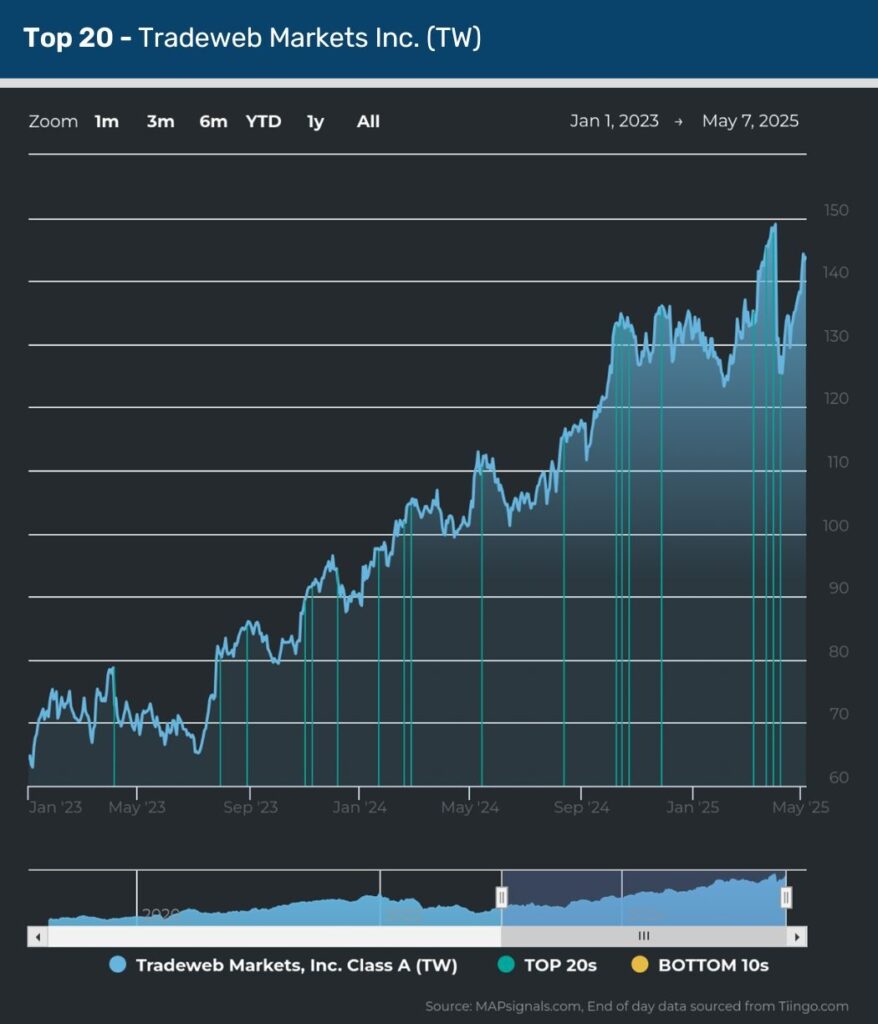

Here’s a great mid-cap example of under-the-radar electronic trading firm Tradeweb Markets (TW).

This company directly benefits from longer trading hours and the rise of trading in more asset classes.

Sales and earnings have been growing massively. But it’s the outlier signals that set it apart from the pack. Below shows each time TW was a top-ranked stock since 2023.

This is the pattern that’s happening today in mid-caps.

Brand new leadership is here.

Author: Lucas Downey